One week ago, ahead of today's Chinese data release which would for the first time capture the devastation from the coronavirus pandemic, we wrote that "to those who have been following our series of high-frequency, daily indicators of China's economy, it will probably not come as a surprise that the world's second biggest economy has ground to a halt, its GDP set to post the first negative print in modern history. To everyone else who is just now catching up, we have some news: it's going to be bad."

Read it all.

Here's another bit of interesting news, via Steve Sailer: Amazon Cancels International and Domestic Travel. Kiss a lot of that cheap counterfeit stuff from China goodbye.

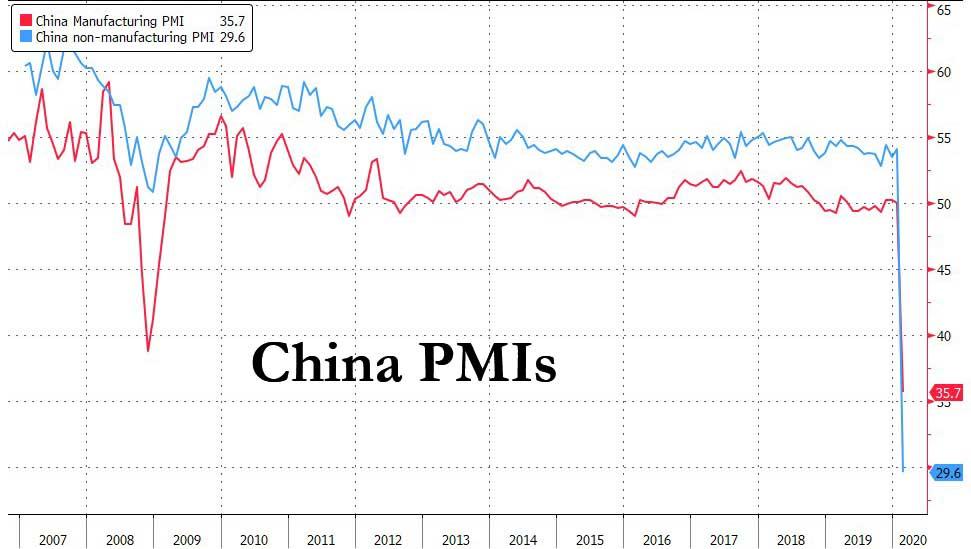

Pretty big story, I'd say. A picture is worth a thousand words:

Eff China.

ReplyDeleteSame for all American multinationals that thought extremely low cargo rates off set the multiplier effect of US jobs.

Honestly, i do not care if this goes into a worldwide depression, but I seriously doubt it, unless this is Soros type play to get rid of Trump.

Ya see, the US is just something to be sucked dry. Our resources and treasure must be for everyone else except US citizens. US companies demand to hire foreign workers, even high paid union Canadian, over US workers.

Eff it all.

Hear! Hear!

DeleteI'll add my 2¢ to TexasDude, Ray and Forbes. Making things in the country not only raises the standards of living of our countrymen, but it's a national security imperative.

Does China imbed Trojan horses in components? I don't know, but, maybe. We know that they require companies to share technology as a condition of selling in their markets. They don't respect intellectual property rights. And, we strengthen a rival who may some day be a battlefield rival.

Amazing how much of our everyday items are either made in China, such as batteries, or depend on Chinese materials, such as medicines.

ReplyDeleteDoes Walmart sell anything that is not made in China?

DeleteSerious question.

The February PMI number for China is down--the March number will be worse yet. China is pretty much shut down. But this is a health-caused crisis with economic implications as a secondary effect, not primarily an economic crisis driven by over-expansion of cyclical credit (the typical bogeyman in recessions).

ReplyDelete1Q20 will show GDP decline, but then followed by a snap back recovery as workers return to work and normal business activity recovers. There will, of course, be disruptions and other distortions resulting, but nothing that isn't ironed in time as sourcing and supply chains are resumed.

And there will be fallout from the business interruptions, including failures and bankruptcy for those firms less resilient to this unanticipated shock. But that should have a cleansing impact as businesses (and families, individuals) learn to be better prepared, and less vulnerable--making the unanticipated less so.

Personally, I'm not surprised by an event of this sort. People, communities, countries are better off, when they are self-sufficient. Sufficiency makes you risk-proof, not risk-prone.

By being more closely lined/reliant on others, risk exposure is exponentially higher as you are exposed to risks others assume, e.g. the social/political/economic path they choose to follow. You you cannot protect against their risks, except by de-coupling from them. It is the classic outcome of complexity and complex systems where close coupling cause cascading fallout when troubles occur.

This is the Butterfly Effect metaphor as described by mathematician Edward Lorenz: A very small change in initial conditions had created a significantly different outcome--as when a butterfly flaps its wings. When China (literally) sneezes, the world catches a cold--or worse.

@Forbes

DeleteAgreed. Orthodox enterprise risk analysis and strategy dictates avoiding over-reliance on a single supplier, customer, financing source, key personnel, etc.

I'd like to make another point. While the equity markets are tanking in expectation of near term poor results coming out of China and otherwise related to the coronavirus crisis, equity markets are ultimately priced based on the present value of expected future results. I can't see how coronavirus impacts the long term (except in a positive way as it forces us to reimagine our risk strategies) and thus I'll go out on a limb and suggest that (absent other unanticipated consequences) the equity markets will discount this as a one-off event and bounce back in the not too distant future.

Yes, that's what I've been wondering:

Delete"I can't see how coronavirus impacts the long term (except in a positive way as it forces us to reimagine our risk strategies)"

Equity markets are often analogized as a discount on the future. Ultimately it is a price discovery process resulting from investors, with different time horizons and risk preferences, supplying offers and making bids for a security based on their instincts (experience, judgment, emotion) about that unknown future--and their changing horizon and preferences.

DeleteRisks with unknown depth and duration will incite a flight to liquidity, as a precaution. That precaution incites further selling cascades. Hence, the past week.

Liquidations stop, buying resumes when the "all clear" is signaled. When that occurs is a guess at this point.

The mob has gathered for blood in the street. A contrarian investment approach is to "buy when there's blood in the street--even if it's your own." When the mob disperses, the moment will have passed.

Contrarian investing is vastly out of favor--momentum trading/investing is the flavor of the day/week/month/decade/century. Jim Simons and Renaissance Technologies is the dean of quantitative investing, i.e. using information theory to trade markets. Fundamentals, whether economic or company, do not enter the picture--only price. And he's far from alone in the quantitative space--an approach that derives its gains from market volatility, not market direction.

I guess my point is that a virus event, even a 'pandemic', is a one-time event, not a fundamental change in earnings potential or investment outlook. It is not like the automobile replacing the horse, spelling the end for buggy whip manufacturers.

DeleteOf course, events in and relating to China recently and since Trump's election (and not just the coronavirus) are going to have consequences and will be applied in price discovery and eventually discounted into present value determinations.

FWIW, I believe fundamentals will always prevail over momentum startegies, etc. In the long run. Just my opinion, but I'm putting my money where my mouth is. :)

"the equity markets will discount this as a one-off event and bounce back in the not too distant future."

ReplyDeleteNo way would I take that risk, seeing that those who called the turn before '08 argue, that this market has been artificially overbought for years, esp. in recent months.

For just one such expert's view, see Nouriel Roubini, at

https://theweek.com/speedreads/899110/stock-markets-are-headed-40-percent-plunge-says-economist-who-predicted-financial-crisis : "equities to tank by 30 to 40 percent this year."

And, for an expert Trader's view, see Gary Savage, at

https://blog.smartmoneytrackerpremium.com/2016/01/chart-of-the-day-213.html , on the prognosis for the Dow-gold ratio getting below 1-1 (currently c. 18-1).

These prognoses are solely based on economic factors as such, and say nothing about the prospect of the sort of huge *political* instability (incl. riots), which could emerge if Durham brings big busts.

(Of course, if Durham's busts eventually lead to a huge D.C. housecleaning, that could be quite bullish long-term, but that result could take *many* years to become clear. Thus, only youngsters, who may be able to ride-out a short-term slaughter of stocks, should risk any major capital on stocks.)

Until Durham actually brings big busts, I'll continue to stay in the much-safer haven of gold.

@Mouse

ReplyDeleteI'm not saying the markets weren't overbought when the correction started. I'm just saying that coronavirus is (itself) a one-off not likely to impact long-term earnings analysis.

As for selling equities to buy gold today, well...good luck. To each his own. You pays yer money and you takes yer chances.

What I wonder is whether the coronavirus thing will accelerate the return of manufacturers to the US. That should work against the CW of Wall St. by helping the working class Trump base.

Delete"coronavirus is (itself) a one-off not likely to impact long-term earnings analysis."

DeleteEven if that particular hope holds up, the political fundamentals reek, until

1) the Dem pick concedes to DJT in Nov., or Dec., or ....

2) Durham shows real results vs. the D.S., who, after all, can move to get power to e.g. confiscate/ freeze your paper Portfolio, via little more than a Nat. Security Letter, w/ which they can them try set you up for a process crime.

If the D.S. can find it, they can use all sort of means against your control of it.

Yep. I believe Steve Bannon opined this morning on Maria B's show that one of the strategic goals of the new USMCA trade deal is to provide an alternative to Chinese sourcing. I would have thought that coronavirus and other concerns re China could only support Bannon's view.

DeleteAnd, as long as judges can order gags against e.g. Roger Stone, I want my assets to be as invisible as possible, lest the D.S. leverage such gag orders to obtain holds on my assets.

DeleteNot that I personally figure to be on their target list, but, rather, that (esp. if DJT loses in Nov.) the D.S. figures to get carte blanche from his successor, vs. all who didn't pony up big $$ to the Dems.

"There's No Pollution" - NASA Satellite Images Expose China's "Production Has Resumed" False Narrative

ReplyDeletehttps://www.zerohedge.com/economics/theres-no-pollution-nasa-satellite-images-expose-chinas-production-has-resumed-false

I've read that they're having a lot of trouble getting workers to return to their jobs.

DeleteRE: Russiagate Retribution. The results of the election will determine whether or not there will be any perp walks. If I were one of the conspirators, I would clam up and hope Trump loses.

ReplyDelete