Rather than go over the sad state of the political order again, I though today would be a suitable time to reprise the sad state of the middle class. Yesterday Charles Hugh Smith had an informative blog republished at Zerohedge, and the title tells the whole story. It's not what you'd call news, but the reminder is sometimes necessary:

The Top 10% Is Doing Just Fine, The Middle Class Is Dying On The Vine

Before presenting Smith's data, which is contained in six graphs, here's another reminder. As Smith is well aware, the hollowing out of our industrial base in favor of a financialization of the economy--with the concommitant progressive engorgement of the left/progressive rentier class at the expense of the middle class--has been ongoing since the Reagan years. However, the transformation of the rentier class into what is increasingly a class of speculators is another aspect of this process that has exacerbated all the worst tendencies Smith will document. This part of the transformation has been brought about by repeated bailouts of Big Finance--definitely not your local banks. Beginning in the Clinton years there have been three bailouts, with the most recent having become an ongoing underwriting of Wall St. by the political class--the Uniparty--which relies on Big Finance for campaign funding. Trump, of course, with his fund raising base comprised of the "little people", was a threat to this order that had to be squelched. And was.

So, with that in mind, consider Smith's presentation of the demise of the middle class, crushed by the "elite" rentier class. Smith characterizes this process as the decapitalization of the middle class--the increasing inability of the middle class to accumulate capital. Smith explains this process at some length, so be sure to follow the link for a full explanation. This will help to understand what's behind the GameStop dustup and the rentier class's reaction to it. It will also outline the challenges lying ahead for the Zhou Baiden regime as it caters to the interests of the rentier class as, protected by the New Army of the Potomac, they seek to complete the process of strip mining the middle class. The Big Question, of course, is: When will push come to shove?

In the meantime, as we await events in the real time of history, here are the results of the process Smith describes, in six graphs.

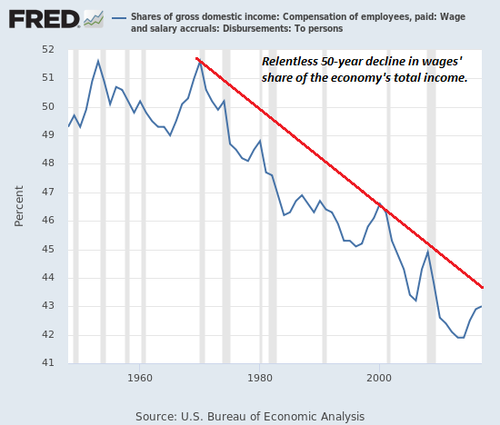

1. Wages' share of the national income has continued a five-decade downtrend. (See chart below) National income since 1973 has shifted from labor (wages) to capital and more specifically, to debt and speculative gaming of the system, a.k.a. financialization.

... (source: https://www.statista.com/statistics/216756/us-personal-income/)

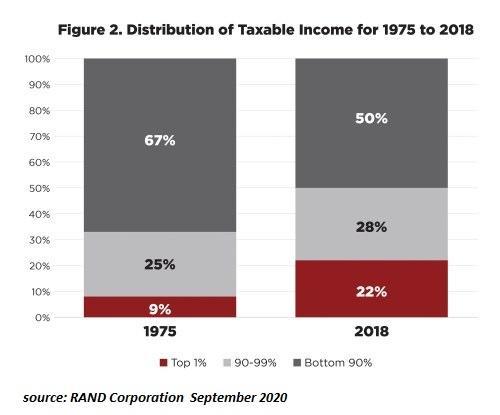

No, this is not a typo. As this RAND report documents, $50 trillion has been siphoned from labor (the lower 90% of the workforce) to the Financial Aristocracy and their technocrat lackeys (the top 10%) who own the vast majority of the capital : Trends in Income From 1975 to 2018.

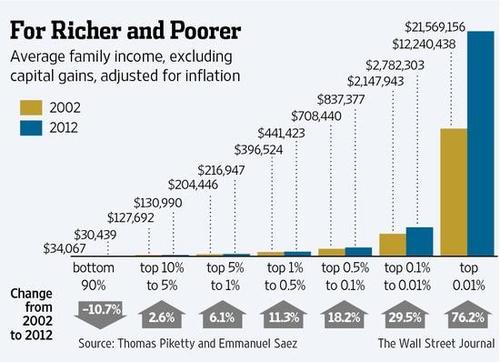

2. Within the workforce, wages have shifted to the top 10% who now earn 50% of all taxable income. Financialization and globalization have decapitalized the skills of entire sectors of the workforce as automation and offshoring reduced the human capital of workers' skills and experience and the value of their social capital. When the entire industry is offshored, skills and professional relationships lose their market value.

In a fully globalized economy, every worker producing tradable goods/services is competing with the entire global workforce, a reality that reduces wages in high-cost developed nations such as the U.S.

Financialization has heavily rewarded workers with specialized gaming the financial system skills and devalued every other skill as only the skills of financialization are highly profitable in a globalized, financialized economy.

3. As the high-wage jobs and capital shifted to coastal urban centers, middle class owners of homes and capital elsewhere saw the value of their assets decline. If a home valued at $100,000 in the late 1990s is now worth $150,000, the owners lost ground even with "official" inflation. In terms of real-world purchasing power, their home actually lost significant value in the past 23 years.

Meanwhile, middle class owners who bought their home in a coastal hot-spot for $100,000 23 years ago are now enjoying home valuations close to $1 million. Homes, along with every other asset, have been shifted into a casino where almost everyone is sorted into winners and losers, less often by skill and more often by luck.

For those who were too young to buy in 1997, sorry--the opportunity to buy a home for three times average middle class income is gone. The lucky generation who bought in the late 1990s in booming coastal magnets for global capital joined the top 10% and their colleagues in less desirable regions lost ground.

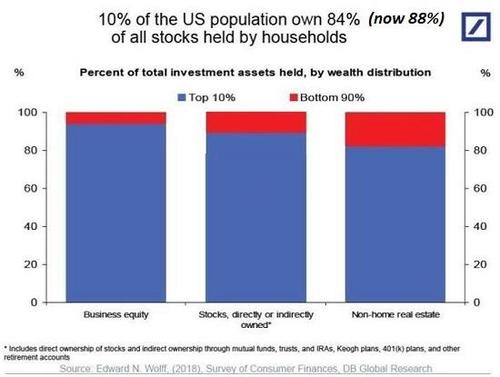

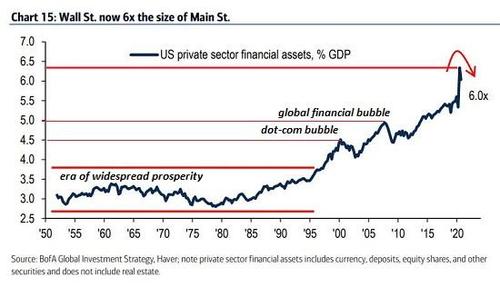

4. As capital siphoned off income and appreciation from labor (human and social capital), the gains accruing to capital accelerated. ...

This had two devastating effects on the middle class: hundreds of billions of dollars that once flowed to savers and money markets disappeared, swallowed by the banks as a direct (and intentional) effect of the Fed's ZIRP (zero-interest rate policy).

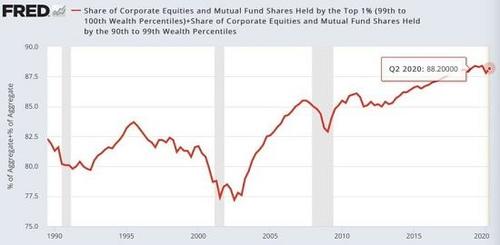

Since the Fed destroyed low-risk yields, anyone seeking any real yield (i.e. above inflation) would have to enter the casino and compete with hedge funds, insiders and the Financial Aristocracy. Very few middle class workers have the skills and experience to beat the pros in the casino, and so income and wealth accrued to those who already owned capital.

This is a key reason why the rich got richer and the poor got poorer. Those with capital accrued the majority of gains in income and wealth, leaving the bottom 90% in the dust.

A recent Foreign Affairs essay Monopoly Versus Democracy included these stunning statistics:

Ten percent of Americans now control 97 percent of all capital income in the country. Nearly half of the new income generated since the global financial crisis of 2008 has gone to the wealthiest one percent of U.S. citizens. The richest three Americans collectively have more wealth than the poorest 160 million Americans. (emphasis added.)

The 3% of income from capital collected by the bottom 90%--which includes the middle class-- is basically signal noise: the middle class collects inconsequential crumbs of income from capital.

Prior to the Fed's ZIRP and financialization of the economy, the middle class could both collect income from capital they owned and they could afford to acquire assets that yielded low-risk solid returns. Now they can do neither. Even worse, the puchasing power of their labor continues to decline, leaving them less able to save and buy assets.

This is why The Top 10% Is Doing Just Fine, The Middle Class Is Dying on the Vine. Please study these charts as a means of understanding the inevitability of economic stagnation and a revolt of the decapitalized middle class.

UPDATE: Boy, this really says it all--again via Zerohedge:

By Eric Peters, CIO of One River Asset Management

“I was looking through reddit chatrooms, wallstreetbets, you know,” said the PM. “Kind of felt surprised by the chatter. I didn’t realize how many people out there understand the extent of the Fed market manipulation that occurred over the past year. Ever since 2008 really,” he continued.

“Not sure why it grabbed me. I suppose I’ve just been under this illusion that it’s mostly people in our industry who see through what has been happening, and that the rest of the people working in random industries, with real jobs, haven’t understood it.” I nodded, faith in our institutions gradually slipping away. “The level of disillusion with the system is kind of breathtaking - I just didn’t appreciate how widespread it seems to be.”

When will push come to shove?

ReplyDeleteLikely, never.

Now that Sil. Valley etc. have total control over the DS, they should have no trouble sniffing out, and sabotaging, any effort by the middle class to prevent its liquidation.